Ready to Report: Complying with FinCEN’s New Beneficial Ownership Rule Under the CTA

- 10.23.2023

By: Mick Bain, Jonathan Wolfman, Zachary Goldman, Monika R. Weisman and Ben Goldfein

Although the Corporate Transparency Act’s (“CTA”) new beneficial ownership rule goes into effect on January 1, 2024, recent polling suggests that many businesses remain either unaware of these upcoming reporting obligations or uncertain of how they will comply. With the Financial Crimes Enforcement Network (“FinCEN”) expecting the rule to impact more than 32 million entities in FY 2024 alone, companies that are unprepared may face serious compliance risk, including potential civil or even criminal exposure.

Background

Enacted in 2021, the CTA represents a significant overhaul of the U.S. anti-money laundering/countering the financing of terrorism (“AML/CFT”) framework and a monumental shift in the landscape of U.S. corporate law. The CTA establishes beneficial ownership reporting requirements for a wide swath of private companies operating in the United States and directs FinCEN to create a secure, centralized, non-public database of beneficial ownership information (“BOI”) to aid law enforcement in countering illicit financial activity, which is often conducted through opaque ownership structures such as shell and front companies.

What Is a Reporting Company?

The CTA applies to “reporting companies,” broadly defined to include both domestic legal entities and foreign legal entities registered to do business in the United States. However, 23 types of entities are exempt from the BOI reporting requirement, including publicly traded companies; banks; insurance companies; certain tax-exempt entities; registered investment companies and advisers; venture capital fund advisers; and pooled investment vehicles.

Another important exemption available to privately-held companies will be for “large operating companies”—those with a U.S. office that employ more than 20 full-time employees and filed a federal tax return in the previous year showing greater than $5 million in gross receipts or aggregate sales. Notably, many early-stage companies and life-sciences companies will not qualify as “exempt entities” (until such time as they qualify as a large operating company) and therefore must comply with the BOI reporting requirement.

Who Is a Beneficial Owner?

A “beneficial owner” of a reporting company is any individual who, directly or indirectly, either (A) exercises substantial control over the

Who Is a Company Applicant?

For domestic reporting companies formed, or foreign reporting companies registered, on or after January 1, 2024, the CTA will also require the disclosure of up to two “company applicants.” A company applicant is any individual who (1) directly filed the documents to form the company or register it to conduct business in the United States; and, where multiple individuals were involved in filing these documents, (2) had primary responsibility for directing or controlling the filing. Company applicants may include attorneys, paralegals, accountants, or outsourced, third-party filing service providers.

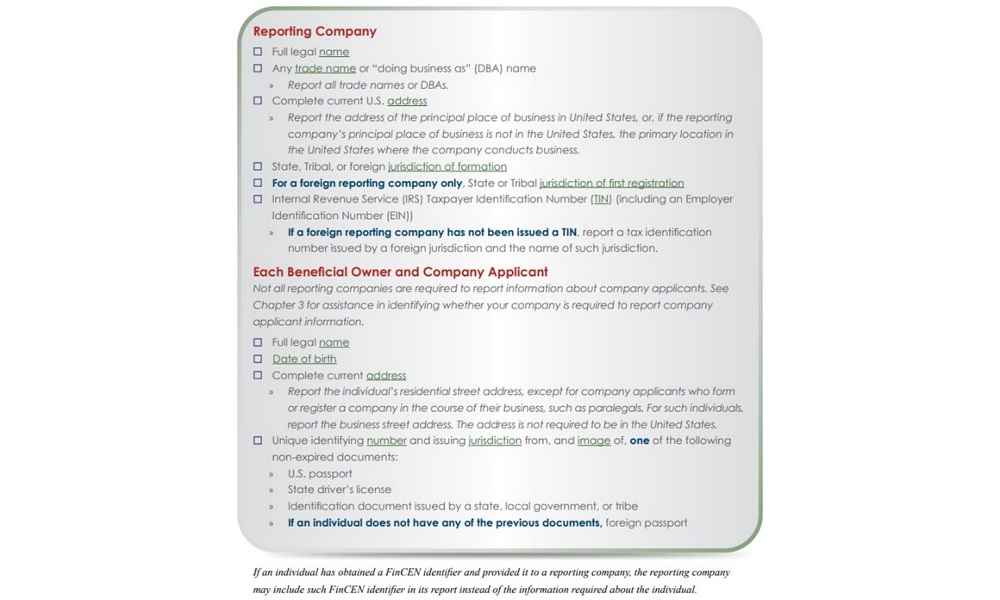

What Information Must Be Reported?

BOI reports must disclose detailed information about reporting companies’ beneficial owners and company applicants, including individuals’ full legal name, date of birth, current address, and a unique identifying number from an official document, such as a passport. Alternatively, a reporting company may simply provide an individual’s unique FinCEN Identifier (“FinCEN ID”). A FinCEN ID is available upon request to individuals who provide the above information to FinCEN as well as to reporting companies at the time of, or following, their submission of an initial BOI report. FinCEN is in the process of finalizing the required BOI Reporting and FinCEN ID Application Forms.

When Must a Report Be Filed?

Reporting companies formed prior to January 1, 2024, must submit their initial BOI report by January 1, 2025. Currently, companies established on or after January 1, 2024, must file initial reports within 30 days following incorporation. However, FinCEN has recently proposed to extend this reporting window to 90 days for companies created or registered on or after January 1, 2024, but before January 1, 2025. Any subsequent changes to reporting companies’ BOI must be reported to FinCEN within 30 days.

Who Can Access BOI Reports?

Although FinCEN is still developing the rule that will govern access to BOI, the agency intends to maintain a Beneficial Ownership Secure System (“BOSS”) database to protect this information. In limited circumstances, FinCEN may disclose reported BOI to a statutorily defined group of governmental authorities and financial institutions. Despite these safeguards, reporting companies should not expect that BOI will remain solely in government hands after the CTA’s new reporting rule takes effect.

What Will the BOSS Look Like?

In its rulemaking to date, FinCEN has expressed an expectation that BOI reports will be submitted electronically as well as an understanding that, in certain circumstances, a reporting company may be unable to file through the BOSS. FinCEN will secure this web portal to the highest information security protection level provided under the Federal Information Security Management Act and will segregate BOI from FinCEN’s existing Bank Secrecy Act (“BSA”) database. FinCEN will provide a high-level overview of the BOSS once the BOI access rule has been finalized.

What’s Next?

Private companies doing business in the United States should immediately seek to determine their reporting obligations (if any) under the CTA. While FinCEN will not accept BOI reports before January 1, 2024, reporting companies should begin collecting information now so that they are prepared to submit within the appropriate timeframe. As FinCEN continues to roll out relevant systems and guidance, WilmerHale stands ready to assist clients in navigating these new and evolving requirements.

Required Information (per FinCEN’s Small Entity Compliance Guide, Chapter 4.1)